Finance Program Major - Bachelor of Science (BS)

Knowing how to manage money is a key to making money.

In the modern financial landscape, experts know how to invest, manage, and capitalize on financial opportunities – skills you’ll develop here at GMercyU.

With exciting and diverse job opportunities that can command high salaries, a BS in finance degree offers an excellent return on your investment.

Whether your goal is to help organizations stay on solid financial footing or trade on the stock market, GMercyU’s Finance Program gives you the educational background and practical skills you need to be successful.

-

942,500

finance and business jobs are projected each year through 2034 (Bureau of Labor Statistics*)

-

$80,920

median annual wage for finance and business jobs in 2024 (Bureau of Labor Statistics*)

-

100%

of GMercyU Finance majors complete at least one internship

-

97%

of recent GMercyU graduates were employed or in graduate school within 6 months (2023 survey results)

-

100%

of full-time undergraduate GMercyU students receive some form of financial aid

Program Details

You’ll learn about money management, including both business and personal finances, as well as how to navigate the stock market through understanding the use of stocks and bonds. You’ll become a source of valuable financial information regarding money management – and you will be prepared to take your place in commercial banks, investment banks, insurance companies, investment companies, brokerage firms, and other organizations around the country and the world.

Apply for this option during your junior year

Boost your employability and earning potential by earning your MBA. With GMercyU's unique 4 +1 MBA, students with a GPA of 3.0 or higher can earn both a bachelor of science degree in finance and a master’s degree in business administration (MBA) in just five years.

Skip the grad school entrance exams by taking graduate credits during your senior year – as part of your undergraduate tuition – and then seamlessly complete your MBA the following year.

Gwynedd Mercy University’s well-rounded program will help you develop specialized finance skills while building your communication and leadership abilities, highly prized skills in today's marketplace. And, you’ll enjoy access to networking opportunities that will build your business contacts before you've graduated.

As a GMercyU finance major, you can:

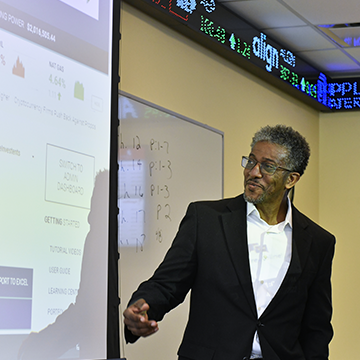

- Take advantage of the unique learning opportunities available in our financial trading room equipped with a real-time stock ticker and Stock-Trak® software for creating simulated investment portfolios.

- Dive deeply into several specialty areas, including investments, risk management, sports business finance, and taxation.

- Learn from expert faculty members (no teaching assistants!) who have extensive experience in both the classroom and the boardroom. GMercyU’s low 10:1 student-to-faculty ratio means individualized support and mentorship from your professors.

- Participate in national business conferences to expand your horizons and begin making connections with the very people who may become your future employers.

- Join the student-led Investment Club to gain some practical experience with managing portfolios and the use of StockTrak as an investment platform.

- Talk with guest lecturers from area businesses who add their own unique insight to your education.

- Develop key skills that all employers value and that GMercyU emphasizes, such as communication, critical thinking, and problem-solving skills.

- Upon graduation and with some work experience, begin a self-study program towards the CFA (Chartered Financial Analyst) designation.

The Finance program’s curriculum spans accounting, marketing, business management, ethics, and statistics. You’ll learn the basics of how businesses are structured and the important aspects of financial planning.

The prerequisite classes will teach you the building blocks of accounting and theories that can be applied in business settings; the management core classes will teach you the principles of business management, as well as statistical courses that will aid in financial planning. Once you’ve earned your degree, your skills will apply to a broad range of financial career paths and will ultimately make you a desirable candidate throughout the job market.

In addition to general education requirements, you will need to complete the following courses to earn your B.S. in finance degree:

Prerequisites - 15 Credits

| ACC 105 | Principles of Accounting I |

| BUS 101 | Business Theory |

| ECN 102 | Microeconomics |

| BUS 212 | International Business |

| BUS 213 | Human Resources and Professional Communication |

Management Core - 30 credits

| ACC 301 | Managerial Accounting |

| BUS 207 | Principles of Marketing |

| ECN 103 | Macroeconomics |

| ACC 106 | Principles of Accounting II |

| BUS 205 | Principles of Management |

| BUS 214 | Business Ethics and Law |

| BUS 209 | Business Statistics I |

| BUS 318 | Operations Management |

| BUS 340 | Business Statistics II |

| BUS 4000 | Seminar: Business Policies & Strategies |

Finance Concentration - 21 Credits

| BUS 310 | Principles of Finance |

| BUS 441 | Internship Required |

| Select 5 of the following 3-credit courses: | |

| ACC 315 | Personal Taxes |

| ACC 316 | Investment & Business Taxation |

| BUS 311 | Money, Banking & Financial Institutions |

| BUS 312 | Managerial Finance |

| BUS 313 | Investments |

| BUS 314 | International Finance |

| SPMT 352 | Sport Business & Finance |

| BUS 375 | Risk Management |

| COMD 410 | Digital Marketing Management |

| BUS 324 | Derivatives |

| BUS 325 | Investments II |

Credit Requirements

A minimum of 120 credits is required for the bachelor’s degree in finance.

Undergraduate Minors

Increase the value of your Bachelor of Science in Finance degree by adding an undergraduate minor that best suits your personal and professional goals.

As you earn your degree, you will develop a solid foundation in the principles of finance along with courses in management, business law and ethics, statistics, and other topics. If you’re wondering what your finance courses would look like at GMercyU, here’s a peek at just a few.

BUS 312 Managerial Finance

An examination of financial decision making in the firm, including the sources of funds, capital structure and long-range financial growth are studied.

BUS 313 Investments

An introduction to the securities markets, their operations and regulations, and alternative investment opportunities are presented. Corporate and government issues, risk and portfolio development will be considered. Current market conditions will be discussed.

BUS 314 International Finance

The course considers the nature and scope of international financial management, investment, international exchange, U.S. balance of payment, and the multinational enterprise will be discussed.

For all Finance program course descriptions, please refer to the undergraduate catalog.

Alan Harper, MBA, PhD

Alan Harper, MBA, PhD

Position: Associate Dean of Operations in Academic Affairs; Associate Professor

Did You Know? Dr. Harper has 20 years of management experience and has published more than 15 peer-reviewed articles.

Read bio

Luigi Corrado, Jr., CPA, MT

Luigi Corrado, Jr., CPA, MT

Position: Assistant Professor

Did You Know? Professor Corrado spent nearly 20 years in the accounting industry as a financial statement auditor, corporate controller, and senior consultant with a variety of firms.

Read bio

Melissa Dennis, DBA

Melissa Dennis, DBA

Position: Assistant Professor, Chair of the Undergraduate Business Department

Did You Know? Dr. Dennis spent 15 years working for Disney Parks, Experiences and Products in customer relationship and customer engagement, supporting Walt Disney World, Disneyland, Disney Vacation Club, and the Disney Cruise line businesses.

Read bio

Maddie Herman, EdD

Maddie Herman, EdD

Position: Assistant Professor and Program Director, Sport Management

Did You Know? Dr. Herman has worked for the Philadelphia 76er's and Wells Fargo Center, and ran GMercyU's Intramurals and Recreation program.

Read bio

Margaret Rakus, EdD

Margaret Rakus, EdD

Position: Assistant Professor

Did You Know? Dr. Rakus has held industry positions in marketing and public relations. She holds certifications in Tableau, Hootsuite, Google Analytics, Google AdWords, and more.

Read bio

[My professors] taught me about the importance of people and growing your network. You can be brilliant, but without people skills, you won’t go very far.

—John Wagner '23 '24, Senior Analyst - Asset Management (former 4+1 MBA student)

Real-World Opportunities

![]() The Griffin Edge is comprised of five touchpoints -- Excellence, Engagement, Experience, Empathy, and Encouragement -- that become the cornerstones of your Distinctive Mercy Experience as a full-time undergraduate student.

The Griffin Edge is comprised of five touchpoints -- Excellence, Engagement, Experience, Empathy, and Encouragement -- that become the cornerstones of your Distinctive Mercy Experience as a full-time undergraduate student.

The Griffin Edge includes an e-portfolio for documenting your GMercyU educational and extracurricular experiences (no matter your major), reflecting on those experiences, and receiving feedback from faculty. It's designed to help you take ownership of your educational journey and chart the right career path for you. It will also help you learn how to talk about your college experiences in meaningful ways — and that can make all the difference in a job interview.

For example, a student might say in a job interview: "I conducted research at the undergraduate level."

A Griffin Edge student might say: "The opportunity to conduct my own research alongside expert faculty taught me the importance of being exact in my data collection and analysis. I was even able to present my findings at our annual research conference! I know this is the career for me."

Learn more about the Griffin Edge here.

GMercyU finance majors regularly intern with some of the top companies in the region. The right internship can act as a powerful springboard toward a successful career, building your resume with relevant work experience and professional references. That’s why completing an internship is a graduation requirement of all finance majors.

Recently, our students have interned at these organizations and more:

- Aetna

- KPMG

- Merrill Lynch

- PricewaterhouseCoopers (PwC)

- United States Liability Insurance

- XL Catlin

- Vanguard

Financial services such as investment planning, mortgage financing, and retirement saving strategies are consistently in high demand. For example, in 2025, U.S. News' ranked Financial Manager as #1 in their Best Business Jobs list and #4 in their 100 Best Jobs list. You can also find a list of top ranked finance jobs at the Bureau of Labor Statistics.

Here’s a look at a few career opportunities to explore; see a longer list below.

Top Jobs for Finance Majors

Personal Financial Advisor

Description: A personal financial advisor works with individuals to develop investment, savings, and debt management strategies. Personal financial advisors work for wealth management firms, insurance companies, or in an independent office.

Degree Requirements: A bachelor of science in finance and additional investment product licensures; some employers may prefer a master’s degree in finance.

Average Salary: In 2024, the average salary for a personal financial advisor in the U.S. was $102,140.

Source

Loan Officer

Description: Loan officers review individual and business applications for loans. Most loan officers work in banks, credit unions, or mortgage companies.

Degree Requirements: A bachelor of science in finance

Average Salary: In 2024, the average salary for a loan officer in the U.S. was $74,180.

Source

Financial Economist

Description: Financial economists analyze trends, collect and interpret data, and study economic issues. Although many economists work in an independent office, some find positions in the government or financial institutions.

Degree Requirements: Some employers will accept a bachelor’s degree in finance for entry-level positions. You may also need to earn a master’s degree or PhD in economics.

Average Salary: In 2024, the average salary for a financial economist in the U.S. was $115,440.

Source

More Career Possibilities for Finance Majors

- Actuary

- Appraiser

- Audit Manager

- Bank Manager

- Bank Representative

- Bookkeeper

- Branch Manager

- Budget Analyst

- Business Analyst

- Business Manager

- CPA

- Chief Executive Officer

- Chief Financial Officer

- Claim Adjuster/Examiner

- Commodities Trader

- Consumer Credit Officer

- Controller

- Cost Manager

- Credit Counselor

- Credit Manager

- Estimator

- External Auditor

- Finance Writer

- Financial Analyst

- Financial Consultant

- Financial Planner

- Foreign Exchange Trader

- Government Official

- Industrial/Institutional Buyer

- Insurance Agent/Broker

- International Trade Specialist

- Investment Banker'

- Investment Researcher

- Investor Relations

- Loan Administrator

- Loan Processor

- Management Accountant

- Market Research Analyst

- Mergers/Acquisitions Manager

- Mutual Fund Manager

- Mutual Fund Trader

- Payroll Administrator

- Portfolio Analyst

- Property Manager

- Rate Analyst

- Real Estate Developer

- Sales Analyst

- Securities Analyst

- Securities Broker

- Stockbroker

- Systems Analyst

- Treasury Management Specialist

- Trust Analyst

*This is only a partial list and not meant to limit you. Some of these careers may require additional education.

The BS in finance program at GMercyU is accredited through the International Accreditation Council for Business Education (IACBE).

Minor Options

Pair your business degree with a valuable minor. Choose from Data Analytics, Digital Communications, Healthcare Administration, Computer Information Science, and more.

Scholarships

GMercyU offers dozens of scholarships and grants to help you get a great education at an affordable cost. They do not need to be repaid and generally are renewable each year.

Transfer

GMercyU grants up to 90 qualifying credits toward a bachelor's degree. GMercyU also offers renewable transfer scholarships and grants ranging from $11,000 to $21,000 a year.