How to Become an Accountant

Businesses and individuals all over the world rely on accounting to keep their businesses up and running. According to the U.S. Bureau of Labor Statistics, the job outlook for accountants is bright – in fact, the anticipated growth is actually at a faster-than-average rate – with an 11 percent increase in available positions projected between 2014 and 2024. Learning how to become an accountant can provide a solid income in a field that’s always in demand. We've compiled a list below highlighting the steps to become an accountant, starting with what to expect as an accounting major.

Steps to Becoming an Accountant

Accounting Degrees and Requirements

How Long Does It Take to Become an Accountant?

Steps to Becoming an Accountant

Step 1: Enroll in a degree program

Step 2: Choose your career path

Step 3: Find an internship

Step 4: Complete your degree

Step 5: Find a job

Step 6: Get certified

For most students, the first step to becoming an accountant begins with coursework in a university setting, but there are a few more steps to take in order to complete your journey. Read on for a detailed description of how to become an accountant.

Step 1: Enroll in a degree program

Regardless of what you plan to do in your career, you’ll need to first earn your Bachelor of Science in Accounting. the first step of learning how to become an accountant. In your accounting degree program, you’ll take math classes and learn about tax law. You can also expect to take business-related courses such as these:

- Financial recordkeeping

- Ethics

- Statistics

- Management

- Personal and business tax

- Auditing

- International finance

Lastly, you’ll want to hone your communication skills, since they will be essential to forming strong working relationships with the individuals and management teams that will rely on your expertise. Students who do well in accounting programs tend to excel at math and be organized, analytical and structured. A bachelor’s degree is the first step in preparing you to sit for the CPA exam or seek entry-level employment as an accountant.

Wondering, accounting vs finance? You could also considering becoming a finance major and exploring your options in that field.

Step 2: Choose your career path

Deciding on a career path is often the next step to becoming an accountant. You can choose to specialize in a particular field of accounting, including managerial accounting, financial accounting, or tax accounting. Or, you can work toward qualifying as a Certified Public Accountant (CPA) or obtaining your MBA, which usually requires additional hours and continuing education.

- Accountants provide a number of important services for their clients. Here are a few examples:

- Bookkeeping

- Auditing financial records

- Completing tax returns

- Offering guidance on the most effective uses for company or personal funds

Most accountants work in private offices or as a part of a corporate team. Some are employed by government agencies at the local, state or federal level. Auditors may travel from one company to another throughout the year to examine financial records and provide objective guidance to clients locally or across a particular region.

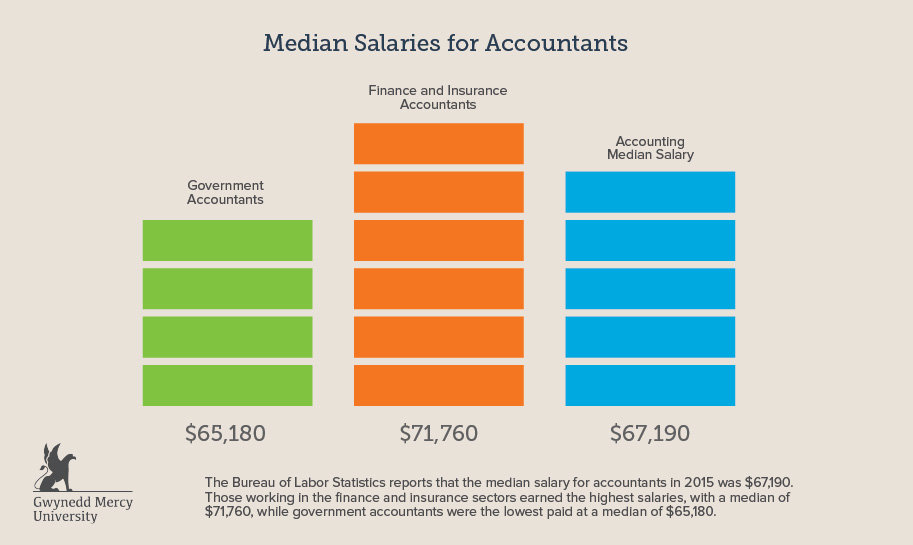

The Bureau of Labor Statistics reports that the median salary for accountants in 2017 was $69,350. Those working in the finance and insurance sectors earned the highest salaries, with a median of $71,760, while government accountants were the lowest paid at a median of $65,180.

Many students find that working at a paid or unpaid internship can provide valuable experience that can pay off in higher wages and increased job opportunities after graduation. Sometimes, an internship can lead to a job offer, so it’s important to be professional, build your network, and give your best effort every day.

Completing your degree program, along with any additional coursework needed, is the next step on your path toward a career in accountancy. Keep in mind, many universities require a specific grade point average if you’re going on to achieve an advanced degree.

With your degree in hand, you’ll be ready to seek and obtain an entry-level position in the accountancy field. You could even earn extra credits required to sit for the CPA exam while working your first job.

Depending on which specialty field you choose, you may elect to obtain one of a number of additional qualifications. Obtaining certifications beyond your degree can improve your marketability and increase your professional credibility:

| Certified Public Accountants | Certified Public Accountants, more commonly referred to as CPAs, are required to pass a comprehensive examination and must have thorough knowledge in the accounting field. These specialists are qualified to represent clients before the Internal Revenue Service and to file reports with the Securities and Exchange Commission. |

| Certified Information Systems Auditors | Accountants with at least five years of experience in the information systems field can take an examination offered by ISACA, formerly known as the Information Systems Audit and Control Association, to be qualified as a Certified Information Systems Auditor. |

| Certified Management Accountants | Certified Management Accountants must have two years of experience in management accounting and pass an examination offered by the Institute of Management Accountants. |

| Certified Internal Auditors | Certified Internal Auditors are required to pass a four-part test administered by the Institute of Internal Auditors and must have at least two years of work experience as internal auditors. |

*A four-year degree in accounting is required as a prerequisite for all these certifications.

Accounting Degrees and Requirements

Choosing an accredited university is essential to ensure the value of your degree after graduation. Smaller class sizes and knowledgeable professors are also key elements to look for so you can achieve success in your career after obtaining your degree. The accounting education requirements will vary depending on the specialty field you choose:

| Management Concentrations | Statistics, finance, management, marketing, law, and ethics |

| Accounting Concentrations | Business and personal taxation, investments, cost accounting, fraud auditing, and general accounting courses |

| CPA Preparatory | International finance, information systems, investments and operations management, in addition to other required coursework |

Internships may be available and can often provide valuable experience that can shorten the additional time you’ll need to achieve other certifications after graduation.

In most cases, students must complete a minimum of 120-125 credit hours to receive a bachelor of science (BS) in accounting. Accounting degree requirements may vary depending on the type of program and the concentration you choose.

How Long Does it take to Become an Accountant?

If you’ve ever wondered how long does it take to be an accountant, there’s no exact answer. The length of time it will take you to receive your degree can vary, and the total time will depend on a number of factors, including how many credit hours you’ve already completed as well as the course of studies you intend to follow.

In general, it takes four years of study to earn a degree in accounting. For students pursuing a CPA certification, there is additional coursework needed, and the total time to complete may be longer, although some institutions offer simultaneous programs allowing you to complete your CPA requirements during your four-year degree program. If you plan to earn your MBA or Master of Accountancy, you will need to factor in additional time for extra graduate-level study and entrance exams, if applicable.

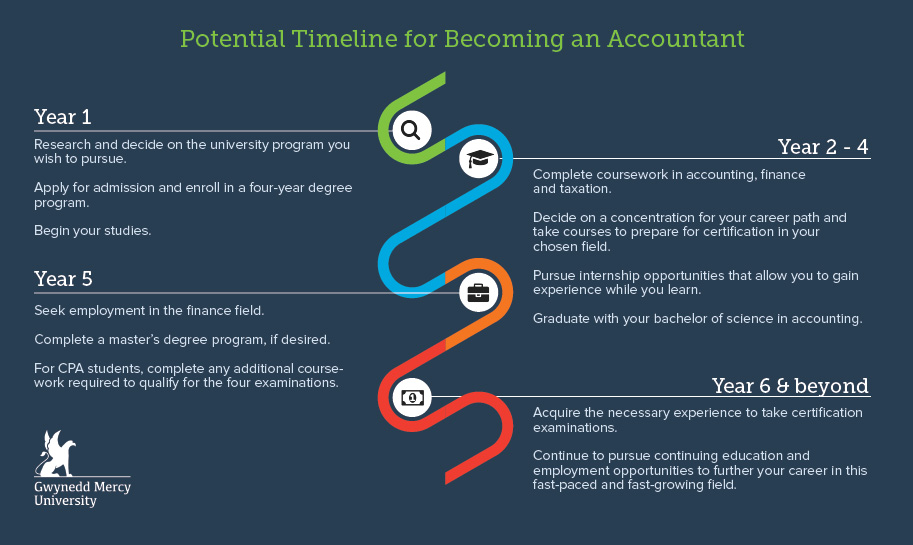

Potential Timeline for Becoming an Accountant:

Year 1:

- Research and decide on the university program you wish to pursue.

- Apply for admission and enroll in a four-year degree program.

- Begin your studies.

Years 2 – 4:

- Complete coursework in accounting, finance, and taxation.

- Decide on a concentration for your career path and take courses to prepare for certification in your chosen field.

- Pursue internship opportunities that allow you to gain experience while you learn.

- Graduate with your bachelor of science in accounting.

Year 5:

- Seek employment in the finance field.

- Complete a master’s degree program, if desired.

- For CPA students, complete any additional coursework required to qualify for the four examinations.

Year 6 and beyond:

- Acquire the necessary experience to take certification examinations.

- Continue to pursue continuing education and employment opportunities to further your career in this fast-paced and fast-growing field.

At Gwynedd Mercy University, we specialize in providing innovative solutions for aspiring accountants. Our faculty members are dedicated to providing the best learning environment possible to support students’ progress effectively.

- Our CPA preparatory track offers the additional 25 credits in coursework needed during the traditional bachelor’s degree in accounting program for students wishing to pursue this advanced qualification in the accountancy field. This track can be completed in just four years, along with your accounting degree. The CPA track can provide a valuable edge upon graduation for aspiring accountants in the competitive employment market.

- We also offer a unique 4+1 MBA option that allows students to earn their bachelor of science degree in accounting and their master's degree in business administration (MBA) in just five years, making it easier to find employment and to achieve their career goals in this fast-growing field.

Visit us online today to learn more about our innovative accounting degree programs and to experience the GMercyU difference for yourself. We look forward to the chance to help you achieve your educational goals and to assist you on your journey toward your career in accountancy.